| I found this info. I wonder if this applies also to US Citizens. I would not mind bringing a tin along the next time I visit the Maritimes. I will be careful however, as my brother and I spent around 2.5 hours at customs and border patrol driving into NB once after making a joke about having an avocado in the vehicle, which was then set aside and completely unpacked, cleared and searched while we both sat in separate rooms...Nice fellows, but not to be messed with. It seems like staying under 200 grams will go a long way. Do First Nations get any sort of break on traditional use grounds? |

|

Stamped Tobacco Products – Personal exemption amounts

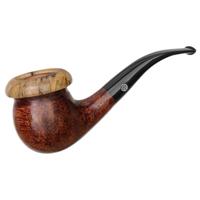

If you wish to import cigarettes, manufactured tobacco and tobacco sticks duty free as part of your personal exemption, the packages must be stamped "

duty paid Canada droit acquitté". You will find tobacco products sold at duty-free stores marked this way.

If you have been away from Canada for 48 hours or more, you may import

all of the following amounts of cigars and stamped tobacco into Canada free of duty and taxes.

| Product | Amount |

|---|

| Cigarettes | 200 cigarettes |

| Cigars | 50 cigars |

| Tobacco | 200 grams (7 ounces) of manufactured tobacco |

| Tobacco sticks | 200 tobacco sticks |